Economist Joseph Schumpeter (1883-1950) is best known for his economic theories on business cycles, capitalism, and for introducing the concept of entrepreneurship. In Capitalism, Socialism, and Democracy (1942), Schumpeter coins the term “creative destruction,” which describes the “process of industrial mutation that continuously revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one.” The term easily applies to economic development organizations (EDOs) and their approach to business retention and expansion.

Where Are Jobs Being Created?

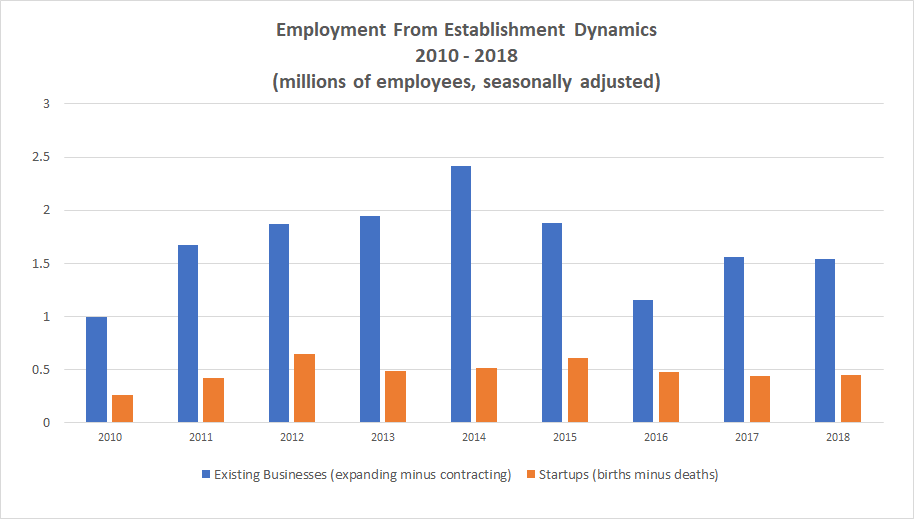

Economic development leaders understand the importance of new and existing businesses. They are keenly interested in existing companies, which create 75 percent of new private-sector jobs. They are also attentive to the 25 percent of new private-sector jobs that come from the churn of new startups minus business closures (U.S. Bureau of Labor Statistics, 2020).

Click on graphic to enlarge

EDO concerns about existing businesses and employment are reflected in the implementation of business retention and expansion programs. Business Retention & Expansion International, in partnership with Eric Canada, CEO, Blane, Canada, Ltd., offer the following definition for such activities:

“In economic development, business retention and expansion is a program designed to strengthen the connection between companies and the community while encouraging each business to continue to grow in the community. Through direct interactions, events, and research, the program seeks to gain insight into business practices, planned future actions, as well as the challenge of targeted companies. Then, to turn this ‘business intelligence’ into value added services, programs, and/or products that address individual and shared company opportunities and problems” (2018).

Properly executed, business retention and expansion programs cultivate a strong business climate and create satisfied CEOs that become effective cheerleaders and tireless goodwill ambassadors for the community. At the same time, business prospects evaluate the community’s economic suitability and receptivity for business through conversations with these same CEOs.

The business retention and expansion toolbox includes business surveys, business walks, industry roundtables and focus groups, and other activities. The level of community engagement adopted by EDOs is a reflection of their social, economic, and cultural environment.

Business Surveys

One technique for soliciting feedback about a community’s business climate is the implementation of business surveys. This requires EDOs to build a database of existing businesses and determine the types of businesses that will be approached (e.g., high-wage firms, firms in select geographic areas, or firms in targeted industry clusters). Hard copies of the surveys are mailed to local businesses and recipients are given two options to provide feedback — online through a SurveyMonkey link or completion of a printed copy of the survey. The information collected protects the confidentiality of respondents and the survey results are reported in the aggregate, helping EDOs to better serve the needs of existing employers.

Business Visitations

Complementing business surveys are volunteer- and economic developer-led business visitations. Visits are focused on interviews with C-level executives to learn how the community might help their company. The interview solicits information about the firm’s plans for expansion or relocation, which is helpful in identifying growth opportunities and at-risk companies. Follow-up is critical and can take the form of a letter or phone call that responds to issues raised during the interview.

Capturing and analyzing the data obtained from business surveys and visitations is an important component of business retention and expansion programs. A variety of software packages are available to help manage survey data and provide insights into local businesses and their economic potential, including:

Bludot

Bludot offers modern, cloud-based software that allows users to view and manage all businesses in the community with one platform. A relatively new product on the market, Bludot is now live at 14 cities located in California, Florida, and Maryland. Bludot recently offered 3 months free usage of their software for any cities that want to support and engage with their businesses during the COVID-19 pandemic. The firm has received funding from the Alchemist Accelerator and GovTech Fund, is a startup partner with City Innovate, and a member of Stanford StartX.

ExecutivePulse

ExecutivePulse is promoted as a Customer Relationship Management (CRM) solution for economic developers, public-sector agencies, and community stakeholders. The product can be used for business recruitment, foreign-direct investment, business retention and expansion, entrepreneurial development, workforce development, and related initiatives. Recent case studies listed on the firm’s website include the Province of Albert, Canada; Birmingham Business Alliance; British Columbia Economic Development Association; Fresno County Economic Development Corporation; Philadelphia Works; Cornerstone Alliance (Southwest Michigan); Province of Ontario, Canada; Commonwealth of Pennsylvania; and San Bernardino County, California.

Gazelle.ai

Gazelle.ai is an “AI-Powered Business Intelligence Growth Platform” designed to identify fast-growth companies for business development. Extremely useful for business attraction and recruitment, the platform also has the ability to identify growth companies in the EDOs own backyard. Client resources include articles, infographics, press releases, podcasts, and webinars.

Synchronist Suite

Developed almost 20 years ago, Synchronist Suite is the granddaddy of crowdsourced economic development software. The platform revolves around business interviews, interview validation, objective analysis, predictive analysis, and key performance indicators. Synchronist provides insight into customer relationship management; each company’s value, growth potential, level of risk, and satisfaction; quality of a market’s retail, education, health care, arts/culture, and other local services; talent development; project tracking; research; and training. The “Synchronist User’s Forum” is held annually to network, share best practices, conduct how-to sessions, and discuss ongoing research projects.

Business Walks

Business walks provide a day dedicated to learning more about local businesses through face-to-face interviews on the business’ turf. They allow teams of community leaders to canvass multiple businesses in one day, covering more ground than traditional business visitations. The teams utilize short, streamlined surveys of predetermined questions to identify issues and bring resources to bear on those issues, and to diagnose firms on the brink of expansion or those at risk. Successful business walks are held in communities throughout the United States and Canada.

Regardless of technique, business retention and expansion programs work best when integrated into the EDOs economic development strategy, business attraction and recruitment, and entrepreneurial development initiatives.

Industry Roundtables and Focus Groups

Anatalio Ubalde, CEO, SizeUp and GIS Planning Inc., has written a thought-provoking article that identifies 10 business retention and expansion innovation trends. He considers industry roundtables and focus groups a superior method of collaborative problem solving. He makes the argument that “the business survey should die,” and outlines their shortcomings when it comes to dealing with the “acting as fast as business” expectations of modern companies. In his opinion, business surveys are not agile enough to anticipate fundamental marketplace shifts.

“The business survey should die.”

Anatalio Ubalde, CEO, SizeUp and GIS Planning Inc.

Business walks help to expand the retention and expansion footprint, but require that EDOs follow up quickly to address the issues raised by businesses. If EDOs are incapable of responding quickly, Anatalio believes they are better off not proceeding with a business walk.

Deliver Direct Value

Ubalde finds there is an inherent conflict between EDO job creation metrics, businesses that are focused on increasing productivity and reducing labor costs with technology, and workforce development. Going forward, the focus of business retention and expansion needs to change. If EDO and local business meetings are to be successful, economic developers have to deliver direct value to local businesses. Delivering direct value means viewing business relationships as a two-way street. Instead of gathering business intelligence and responding in-kind, Ubalde contends that EDOs should use Internet-delivered technology to proactively deliver assistance to a broader constituency of local businesses. This takes the form of data and information that helps them better understand company performance, find customers, and improve operations.

A market-driven economy is going to produce a certain amount of “churn” or “creative destruction” over time. In fact, strong economies are characterized by high rates of churn and high rates of economic growth. The challenge for economic development professionals is determining how to help businesses survive and grow in the midst of inevitable change, while mining business intelligence data.

Editor’s Note: “Beyond the Survey: How EDOs Add Value Through Business Retention and Expansion” explains how EDOs are moving from basic survey and visitation models to more comprehensive, value-added models. The paper outlines the various ways EDOs are serving businesses, measuring their activities, and promoting them in the community.

###